Some Known Details About Pkf Advisory Services

Some Known Details About Pkf Advisory Services

Blog Article

Some Known Details About Pkf Advisory Services

Table of ContentsSome Ideas on Pkf Advisory Services You Need To KnowSome Known Details About Pkf Advisory Services Indicators on Pkf Advisory Services You Should KnowThe Facts About Pkf Advisory Services UncoveredMore About Pkf Advisory Services

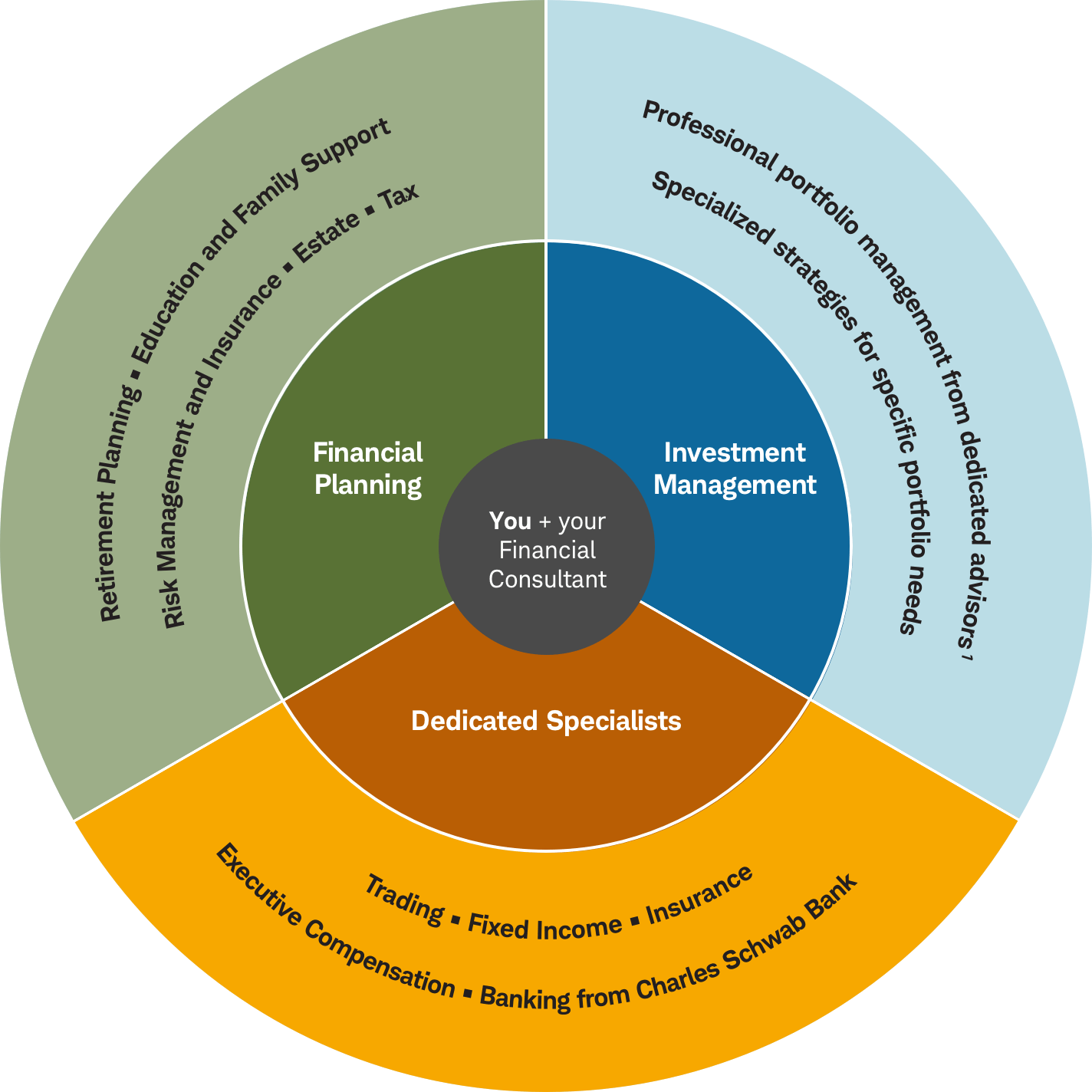

If you're looking for extra details beyond what you can find online, it's very easy to obtain begun with a detailed, customized monetary plan that you can evaluate without expense or commitment. Enjoy the ongoing support of a dedicated advisor in your corner.The T. Rowe Rate Retired Life Advisory Service is a nondiscretionary monetary planning and retirement income preparation solution and an optional managed account program given by T.

Brokerage accounts brokerage firm the Retirement Advisory Service are solution by Given Rowe Price Investment Rate, Solutions, member FINRA/SIPC, and are carried by Pershing LLC, a BNY Mellon company, firm NYSE/FINRA/SIPCParticipant which acts as a clearing broker for T. Rowe Price Investment CostFinancial Investment Solutions. Via this work, we assist establish the needed conditions that will certainly bring in the most personal capital, making it possible for the personal market to expand. IFC is moving to a much more strategic approach, methodically linking our consultatory programs to the greatest needs determined in Globe Bank Group country and sector methods.

Financial recommendations can be useful at transforming points in your life. Like when you're beginning a household, being retrenched, planning for retired life or taking care of an inheritance. When you meet a consultant for the very first time, work out what you intend to get from the guidance. Before they make any kind of recommendations, an advisor ought to make the effort to discuss what is very important to you.

The Only Guide for Pkf Advisory Services

As soon as you've concurred to go in advance, your monetary adviser will prepare an economic prepare for you. This is provided to you at an additional conference in a document called a Declaration of Advice (SOA). Ask the adviser to clarify anything you don't comprehend. You must always feel comfortable with your advisor and their recommendations.

Place a time limitation on any kind of authority you provide to purchase and offer financial investments on your behalf. Firmly insist all document regarding your financial investments are sent out to you, not just your adviser.

This may happen during the conference or digitally. When you get in or renew the continuous fee plan with your adviser, they ought to define exactly how to finish your partnership with them. If you're transferring to a new adviser, you'll require to arrange to move your monetary documents to them. If you need assistance, ask your advisor to explain the process.

See This Report about Pkf Advisory Services

Numerous properties come with liabilities affixed. So, it becomes essential to determine the actual value of a property. The understanding of working out or canceling the obligations features the understanding of your financial resources. The overall process aids develop properties that do not come to be a burden in the future. It made use of to be called saving for a stormy day.

Why? Like your best auto individual, financial experts have years of training and experience behind them. They have a deep understanding of economic items, market motion, and run the risk of administration so you can rely on that the decisions that make up your monetary plan are made with confidence. How will you know these choices are made with your benefit in mind? If your monetary advisor is a fiduciary, then they are legally obligated to act in your best interest not click for more info their own.

The 4-Minute Rule for Pkf Advisory Services

This is what you can make use of to try the sushi put the street or see your their explanation favored band at Red Rocks. PKF Advisory Services. When it pertains to taxes, an excellent financial advisor will certainly guarantee that you're only paying the minimum quantity you're called for to pay, helping you placed a few of your hard-earned cash back in your pocket

The prospective value of financial recommendations relies on your economic circumstance. Whether you're just getting going or well into retirement, getting expert guidance or a consultation regarding your funds can be valuable at every stage of life. Below are 5 common reasons to employ a monetary consultant. You need aid establishing economic goals for your future You're unsure exactly how to spend your cash You're in the middle of (or getting ready for) a major life event You require responsibility or an impartial second viewpoint You just don't like taking care of cash To identify if working with an economic consultant is best for Website you and guarantee an effective partnership, the most effective thing to do is ask excellent concerns in advance.

If it does not feel right, it's OK to discover other choices. Right here are a couple of instances of questions you can ask a monetary advisor in the first conference. A financial consultant that is a fiduciary is needed by law to act in your benefit. This implies that they can only recommend economic techniques that profit you, no issue what stage of your financial trip you're in.

Report this page